Sustainability

SANKEI REAL ESTATE intends to conduct management that takes into consideration environment, social and governance (ESG) together with the Asset Management Company for the purpose of social sustainability and enhancement of unitholder value over the medium to long term.

Sustainability Policy

The Asset Management Company, in the course of asset management business of SANKEI REAL ESTATE, has established the Sustainability Policy in its Asset Management Guidelines for the purpose of enhancing sustainability initiatives with the belief that sustainability of ESG (environmental, social and governance) considerations will be essential for improvement of the medium- to long-term competitiveness of SANKEI REAL ESTATE and the sustained growth of unitholder value.

TCFD

the asset management company has expressed its support for the recommendations of the Task Force on Climate-related Financial Disclosures (“TCFD”) and joined the “TCFD Consortium”, a group of domestic companies that supports TCFD recommendations.

The TCFD

is an international initiative established to examine how climate-related disclosure should be addressed and how financial institutions should be supported, among other items. The TCFD has published recommendations for companies and others to disclose regarding climate change-related risks and opportunities in the areas of Governance, Strategy, Risk Management, and Metrics and Targets.

The TCFD Consortium

was established to discuss how Japanese companies and financial institutions supporting the TCFD recommendations can promote effective corporate information disclosure and how to link disclosed information to appropriate investment decisions by financial institutions.

GRESB

In the 2023 GRESB Real Estate Assessment, SANKEI REAL ESTATE acquired a “2 Stars” in GRESB Rating, which is based on GRESB Overall Score and its quintile position relative to global participants. It also acquired a “Green Star” by achieving high performance both in “Management Component” that evaluates policies and organizational structure for ESG promotion, and “Performance Component” that assesses environmental performance and tenant engagement of properties owned.

The GRESB

is the name of an annual benchmark assessment measuring consideration for the environment, society and governance (ESG) in real estate companies and funds, and the organization that manages this. It was founded in 2009 by a group of major European pension funds leading the Principles for Responsible Investment (PRI). Institutional investors worldwide, as well as the General Pension Investment Fund (GPIF) in Japan, utilize Global Real Estate Sustainability Benchmark (GRESB) data in selecting investment targets and in dialogue with portfolio companies. Many real estate companies, REITs and private real estate funds take part in the annual evaluation.

Sustainability Policy

- Preserving the Earth environment and reducing the environmental load of assets under management

We will aim for the preservation of the Earth environment by promoting resource conservation, energy saving, water saving, effective use of water resources, waste reduction, recycling and other efforts at our assets under management for contribution towards a sustainable society and coexistence with nature. Moreover, specific initiatives will be stipulated for achieving environmental targets in greenhouse gas emissions, water consumption, waste output and such at our assets under management in an effort to reduce the environmental load. - Serving the local community

We will endeavor to serve the local community and establish good relations in the surrounding area through our assets under management. - Cooperating with external stakeholders

We will aim to establish good relations with the tenants, property management companies and master lease companies of our assets under management as well as other outside stakeholders and aim to put the sustainability policy into practice through collaboration and cooperation. - Working with executives and employees

We will implement continuous education and awareness-raising activities concerning ESG to deepen the understanding of executives and employees with regard to ESG considerations and increase their abilities. Moreover, we will establish an environment where each executive and employee can exert their ability to the fullest by creating a healthy, safe and comfortable work environment, nurturing human resources and initiating work-life balance. - Observing compliance and establishing/maintaining an internal control system

We will observe ESG-related laws and regulations as well as compliance and endeavor to further strengthen the internal control system to ensure fair transactions, appropriate management of information and prevention of conflicts of interest in an aim to meet the expectations of all stakeholders. - Disclosing ESG information and securing transparency

We will endeavor to disclose information regarding ESG in a timely and appropriate manner and secure transparency by utilizing outside evaluations such as with the acquisition of environmental certifications and utilization of international standards.

Environment

As part of efforts to give due consideration to as well as coexist harmoniously with the environment, the sponsor has obtained environmental certifications for the properties it has developed and manages the properties. Like its sponsor, SANKEI REAL ESTATE intends to manage its properties in an environmentally friendly manner.

DBJ Green Building Certification Program

The program evaluates, certifies and supports properties which are required by society and economy. It makes comprehensive assessment of properties, while evaluating various factors which range from properties’ environmental features to their communication with stakeholders, such as disaster prevention and proper care for surrounding communities.

A-1Tokyo Sankei Building(2% co-ownership interest)

Certification Receiver : The Sankei Building Co., Ltd.

A-3S-GATE NIHONBASHI-HONCHO

Certification Receiver : SANKEI REAL ESTATE Inc.

A-4S-GATE AKIHABARA

Certification Receiver : SANKEI REAL ESTATE Inc.

A-10S-GATE AKASAKA

Certification Receiver : SANKEI REAL ESTATE Inc.

BELS evaluation

A-3S-GATE NIHONBASHI-HONCHO

A-4S-GATE AKIHABARA

A-10S-GATE AKASAKA

B-1Hotel Intergate Tokyo Kyobashi

B-2Hotel Intergate Hiroshima

Social

SANKEI REAL ESTATE puts forth efforts to contribute to local communities and build amicable relationships with the surrounding areas.

Introduction of share service for electric micromobility

A-12 Hitachi Kyusyu Building

A-7 Toyo Park Building

SANKEI REAL ESTATE promotes introduction of share service for electric micromobility to contribute to the realization of a carbon-neutral society, while striving to improve convenience for tenants and increase property value.

Governance

Aim for enhancement of unitholder value over the medium to long term by creating a management structure that contributes to unitholder interest.

Asset management fee system

Fee for a fiscal period

| Asset Management Fee I |

Total assets X 0.5% per annum (maximum) |

|---|---|

| Asset Management Fee II |

Profit from real estate leasing business X 5.0% (maximum) |

Acquisition and disposition fees

| Acquisition Fee | Acquisition price X 1.0% (maximum) |

|---|---|

| Disposition Fee | Disposition price X 1.0% (maximum) |

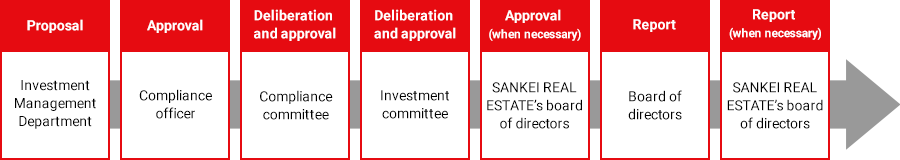

Management Structure(Decision-making flow chart (in the case of property transactions with an interested party))

In the case of property transactions with an interested party, Sankei Building Asset Management makes it a rule to obtain approval from its compliance committee, which has an external member, and its investment committee, as well as approval from SANKEI REAL ESTATE’s board of directors (when necessary.)

Contributions to SDGs (Sustainable Development Goals)

SANKEI REAL ESTATE’s efforts have contributed to the following SDGs.

-

Target 3

Target 3

Ensuring prevention of the spread of infectious diseases, flexible work styles -

Target 7

Target 7

LEDs, solar power, reduction of heat load -

Target 8

Target 8

Rooftop terraces (worker-friendly buildings) -

Target 11

Target 11

Green Building certification, seismic dampers, stockpiles -

Target 12

Target 12

Appropriate treatment and recycling of industrial waste -

Target 13

Target 13

Disaster countermeasures, intake of people having difficulty returning home